greenville county property tax payment

Diane Henderson Assistant Tax Collector Greenville County Tax Collectors Office Ph. Greenville IL 62246.

Accepts payment of current Real and Personal Property taxes in person by mail by outside lockbox and through internet transactions.

. 903 408-4001 Chamber of Commerce Office 1114 Main St. Paying Taxes With a Mortgage. Retain the upper portion of the bill for your records.

Business Personal Property BPP Tax is a property tax on the depreciable assets of a business. This information includes both paid and unpaid property taxes on all parcels in Greene County. If your mortgage includes an escrow account for payment of property taxes you are responsible to notify your mortgage lender of the tax amount due and to verify with the Pitt County Tax Collector that payment has been received.

Search Peach County property tax billing and payment records by owner name or account number and pay property taxes online. SC County Tax Assessors Please note. N Birmingham AL 35263 Visit Jefferson Countys website Visit Jeffferson Countys Property Tax Administration Website Visit Jefferson County Map Viewer for Appraisal Assessment Records P.

Your payment is considered received as of the Post Mark date. 716 Greenville Hwy next to County Barn 2 in JP 2 Office Building Hours. Jefferson County Gaynelle Hendricks Tax Assessor Jefferson County Courthouse 716 Richard Arrington Blvd.

Find your tax bills online here. For 2013-14 Greenville was ranked in the top 10 by the Financial Times for micro American cities of the future and human resources. Amendments to the South Carolina Electronic Filing Policies and Guidelines 05-27-2022 South Carolina Advance Sheet 05-18-2022 Chief Justice Beatty Issues 2021 Judicial Branch Annual Report 05-11-2022 Amended Order Regarding the Methods of Electronic Filing and Service Under Rule 262 of the South.

All taxes are accessed by the county. Meriwether County Tax Assessor 124 North Court Square Greenville GA 30222 Phone 706672-4222 Fax 706672-0598. Allendale County Property.

Smallwood Tax Collector P. A Forbes report in 2014 ranked the City of Greenville in the top 10 for best small places for business and careers and in the top 25 for mid-city business growth and development. Search Vehicle Real Estate Other Taxes.

Additionally the Milken Institute. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments. This is a property tax increase.

VEHICLE REGISTRATION AND RENEWAL In addition to tax information found in the MyDMV website you can also access certain payment and renewal services at the NCDOT website by CLICKING HERE. Assessor Moultrie County Assessment Officer Moultrie County Courthouse 10 South Main St Suite 8 Sullivan IL 61951 Phone. But that will not gain them title to the property.

Mail the appropriate payment stubs and your payment to Bond County Collector 206 W Main St Greenville IL 62246. Online payments may take up to 4 days to reflect payment. Aiken County Pay taxes online Property and car search.

Search Moultrie County property tax and assessment records by parcel number owner name or street address and pay property taxes online. Identifies your particular piece of property. Tax Collector Suite 700.

What is Business Personal Property Tax. Abbeville County Pay taxes online property and car search. Property typically includes the furniture fixtures and equipment that are owned and used to operate a business.

The issuance of 35058000 of bonds by the Community Independent School District for a multi-purpose indoor facility and levying the tax in payment thereof. 2500 Stonewall Street Suite 101 Greenville TX 75403. For more tax information see the SC Tax Guide.

830 - 1200 100 - 400 Monday through Friday. Vote for None or One. Services available at this website include.

Terrell Independent School District Proposition A. Lenders often roll property taxes into borrowers monthly mortgage bills. Vehicle Property Tax.

To determine how much property tax you pay each month lenders. During the first seven months of each year the current year property taxes are in the hands of the town tax collectors. The Greene County Treasurers Office offers property tax information to the public on the internet.

Tax Rates The Pitt County Board of Commissioners sets County. Please call Pitt County Tax Administration at 252-902-3400 for questions or assistance. Only search using 1 of the boxes below.

No taxes are accessed by cities or towns in South Carolina. It is located on your tax bill in the upper right in the Permanent Property Number box. The Wood County Tax Office will begin performing boat registrations and accepting credit card payments for vehicle and boat registrations at the main office in Quitman or any of our substations.

Greenville Property Management And Property Managers Greenville Houses And Homes For Rent Marchant Property Management

17 Things To Know Before Moving To Greenville Sc

Greenville Property Management And Property Managers Greenville Houses And Homes For Rent Marchant Property Management

Live Local 2021 Greenville Journal

Greenville County Register Of Deeds Facebook

Why Land Values Are Rising In Greenville County South Carolina

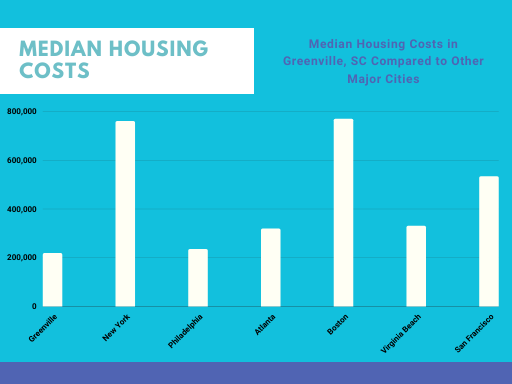

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Greenville County Register Of Deeds

Pickens Sc Homes For Sale And Real Estate In Pickens Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Williams Gr Real Estate Estates Lake Keowee

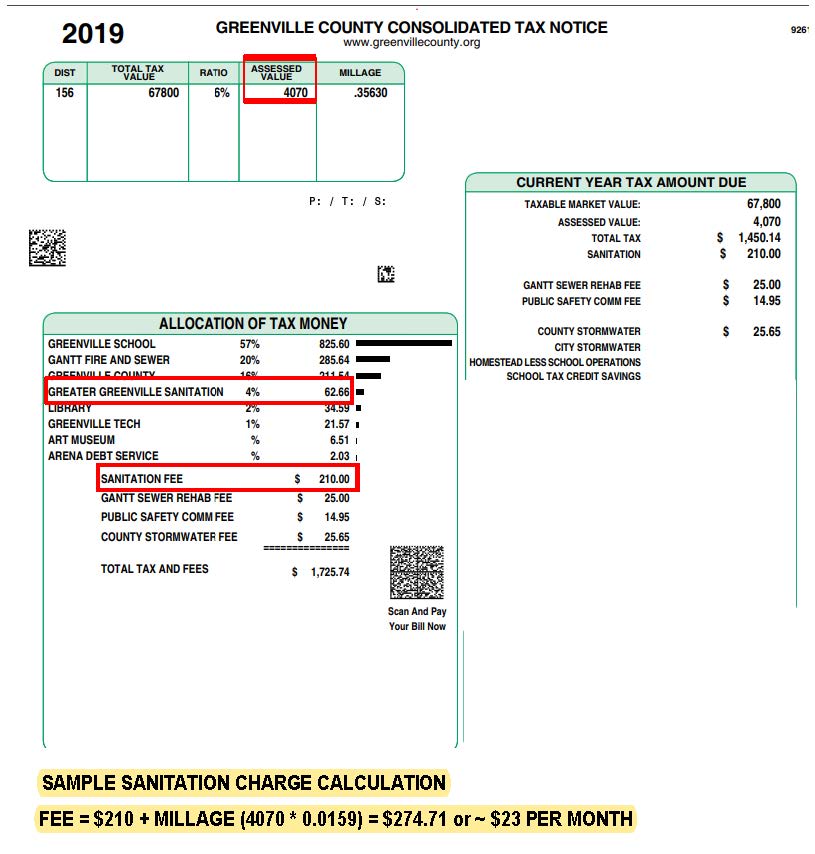

Fees Annexation Greater Greenville Sanitation

Do Oklahomans Typically Have A Southern Or Midwestern Accent Tulsa Find A Job School Oklahoma City Ok Page Rock County West Linn Allegheny County

Terms Greenville County Tax Collector Sc Online Payments

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal